Greece offers two exceptional programs tailored to international individuals and investors: the Greek Golden Visa Program, providing residency through investment, and the Non-Dom Tax Regime, offering attractive tax incentives for those transferring their tax residency to Greece. Both programs are designed to combine financial advantages with access to a vibrant and thriving economy.

Greece’s Golden Visa program offers residency to non-EU nationals who make a qualifying investment, including real estate (€250,000–€800,000 based on location and property type), a €500,000 business investment, or financial investments such as a €500,000 deposit or €350,000 in shares.

Greece’s Non-dom Tax Regime allows foreign individuals transferring tax residency to Greece to pay a flat annual tax on foreign income, without needing to declare it domestically. Eligibility requires a €500,000 investment in Greece within three years, which can be in real estate, securities, or shares in Greek-based entities.

Expand your global mobility with visa-free travel across Europe’s Schengen Area through the Greek Golden Visa Program, making business trips and family holidays convenient and hassle-free.

Take advantage of Greece’s favorable tax regime through the Non-Dom Tax Program, as well as lucrative real estate investments and opportunities to establish businesses in a thriving European market.

Benefit from access to world-class education, advanced healthcare systems, and Greece’s dynamic economic environment, creating opportunities for your family’s academic and professional success.

Live in one of the world’s most secure and culturally rich countries, with a high standard of living, political stability, and a welcoming Mediterranean lifestyle.

Greece is a Mediterranean nation consisting of a peninsular mainland and thousands of islands in the Aegean and Ionian Seas. It has a total area of 131,957 km².

Greece has a population numbering 10,720,000 people. The official language is Greek.

Greece is a very a popular tourist destination with an increasing influx of tourists every year, having received 34.2 million tourists in 2019 – more than three times its resident population.

Pre-primary, primary and secondary school is compulsory for students aged between 4 to 15 in Greece. Most Greek students then proceed onto upper-secondary education, either at a general or a vocational Lykeio, of which there are both daytime and evening ones. The country also has a thriving tertiary education system, with some of the highest-ranking universities in the world.

The country has a history of providing publicly funded or subsidised health care through the National Health System (ESY).

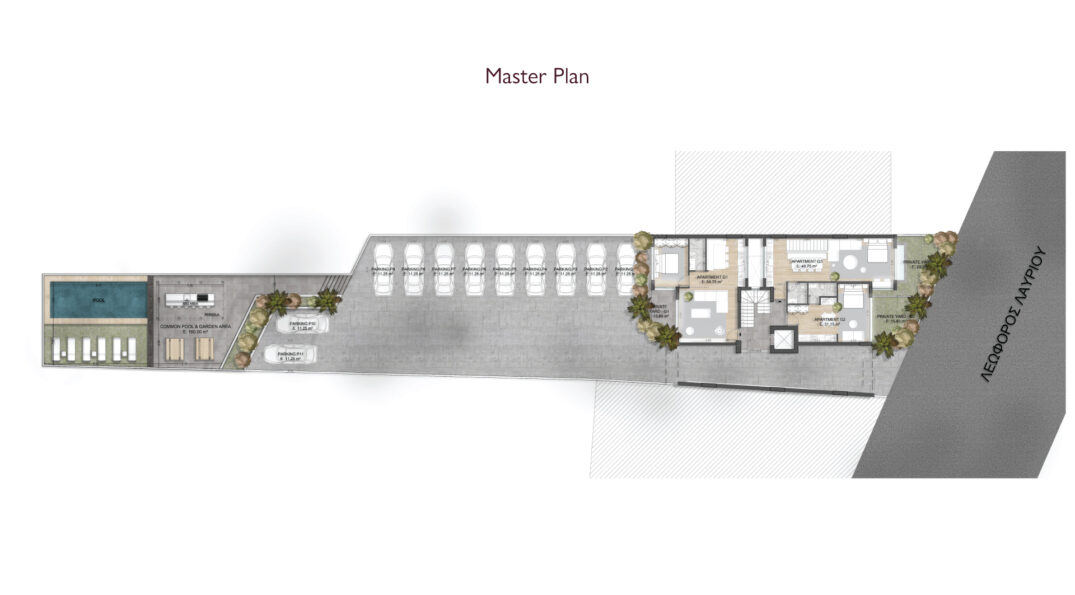

| Property Type | Bedroom | Area m2 | Price |

|---|---|---|---|

| Apartment | 1 | 58.75 | PRICE ON REQUEST |

| Studio | 31.15 | PRICE ON REQUEST | |

| Studio | 93.60 | PRICE ON REQUEST | |

| Apartment | 1 | 59.30 | PRICE ON REQUEST |

| Apartment | 1 | 50.65 | PRICE ON REQUEST |

| Studio | 33.80 | PRICE ON REQUEST | |

| Studio | 47.00 | PRICE ON REQUEST | |

| Apartment | 1 | 59.30 | PRICE ON REQUEST |

| Apartment | 1 | 50.65 | PRICE ON REQUEST |

| Studio | 33.80 | PRICE ON REQUEST | |

| Studio | 47.00 | PRICE ON REQUEST |

| Property Type | Bedroom | Area m2 | Price |

|---|---|---|---|

| Apartment | 3 | 145 | PRICE ON REQUEST |

| Apartment | 3 | 137 | PRICE ON REQUEST |

| Apartment | 4 | 282 | PRICE ON REQUEST |

Greece offers a combination of financial, lifestyle, and mobility benefits. With its strategic location, favorable tax policies, high quality of life, and access to the Schengen Area, it’s an ideal choice for investors and individuals seeking growth and stability.

Greece provides two key programs: the Greek Golden Visa, offering residency through investment, and the Non-Dom Tax Regime, which provides attractive tax benefits for individuals transferring their tax residency.

No, both programs are designed with flexibility in mind. For the Greek Golden Visa, there’s no requirement to reside in Greece, and for the Non-Dom Tax Regime, applicants enjoy tax benefits without mandatory residency.

Yes, both programs allow for family inclusion. The Greek Golden Visa covers spouses, children under 21, and parents of the applicant and spouse. The Non-Dom Tax Regime can be extended to family members for an additional flat tax.

Applicants can invest in real estate (ranging from €250,000 to €800,000 depending on location and property type), business establishment (€500,000 minimum), or financial investments (€350,000 to €500,000).

Applicants must not have been Greek tax residents for 7 of the last 8 years and must invest €500,000 in Greece, or alternatively, hold a Greek Golden Visa.

The Greek Golden Visa process typically takes up to 6 months, while Non-Dom Tax Regime applications must be submitted by March 31 and are processed promptly after all requirements are met.

Non-dom tax residents pay a flat annual tax of €100,000 on foreign income, regardless of the amount, with no requirement to declare it in Greece. Family members can be added for €20,000 each, with no additional tax for minor children.

Velment does not share, sell or exchange under any form, the data or any other information concerning its clients.